The 3 Financial Reports Every Smart Entrepreneur Needs

There’s one fact that no business owner can escape – you must learn basic accounting. But far from being an arduous and intimidating job you really only need 3 financial reports in your business.

If you’re already using accounting software like as Xero or Saasu or Wave, you should be able to access these reports easily. Or alternatively your accountant or bookkeeper will be able to provide these reports for a small fee.

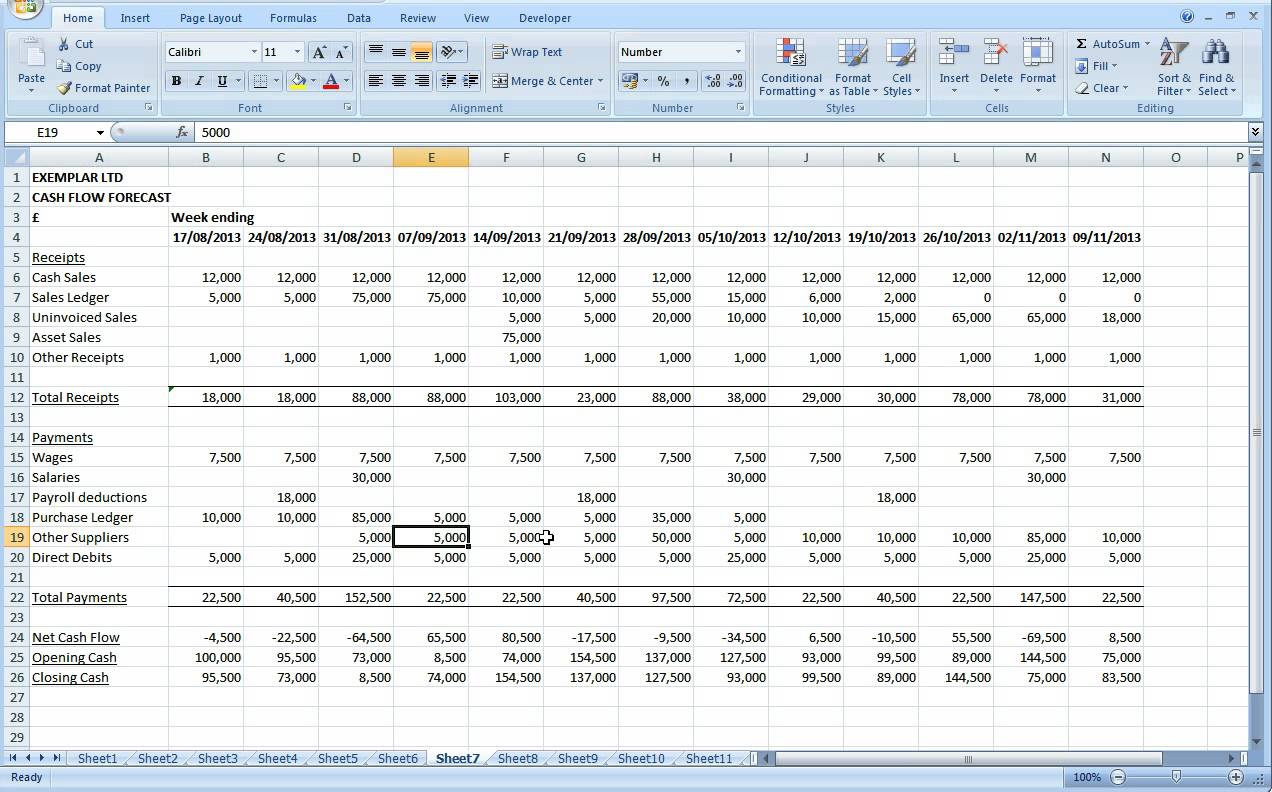

Weekly/Monthly Cash Flow Forecast

Your cash flow forecast tells you how much cash you have available now and what that figure will be at any given time in the next 6 to 12 months.

In our opinion it’s the most important financial report there is.

Image Source: Prospero FD

To put together your forecast you need to track…

- Projected cash outflows: add up your monthly overheads but factor in how your people, marketing and operational expenses will change in the coming months. You should also include taxes – VAT collected and paid out, PAYE, NI, corporation tax – and when those bills are due.

- Projected cash inflows: forecast your cash inflows but take into account the amount of time it takes for clients to pay their invoices. If you invoice a client in January, but don’t get paid for 3 months, then you should show that cash as received in April.

The point of your cash flow forecast is to act like an early warning system. If your business hits a rough patch, you can see how it’s going to affect your cash flow and adjust as necessary.

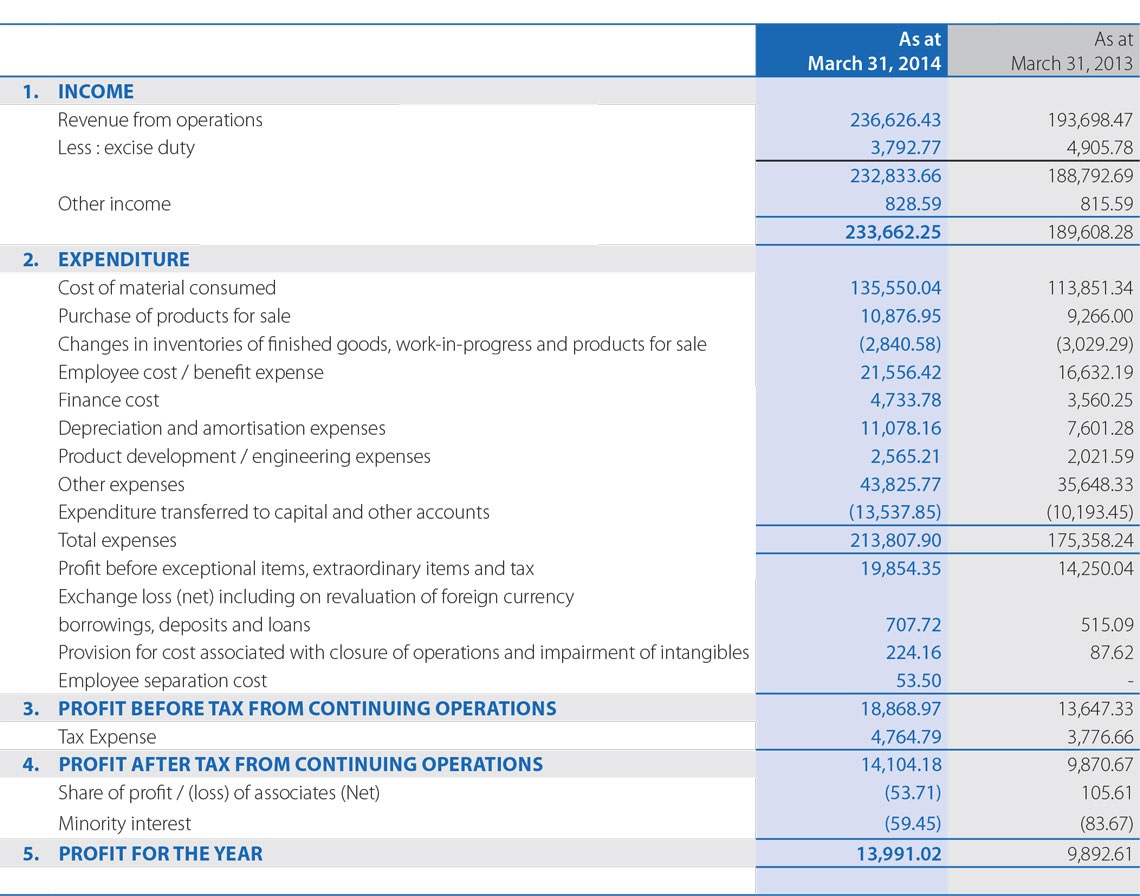

Monthly Profit and Loss Statement (P&L)

The most important financial goal of any business is to make a profit. The monthly profit and loss statement shows you how successful you have been in achieving that goal.

Many businesses only receive profitability informational annually, which is not enough to really understand the performance of their business, hence we advocate monthly or quarterly.

Your P&L statement shows all revenue received, and what the costs were to generate that revenue.

Image Source: Tata Motors

You will need to track…

- Turnover: the value of sales made in a trading period.

- Cost of sales: the direct costs of manufacturing items, or buying in items to sell them.

- Expenses: the overhead costs of running the business

- Profit: the net figure left when cost of sales and expenses have been deducted.

By keeping a keen eye on your P&L statement you’re able to maximize your profit margins and understand how your business works as a profit generation machine.

Also it’s useful when you’re getting your business ready for sale, as you’ll need to show a net profit that’s growing in order to look attractive to investors.

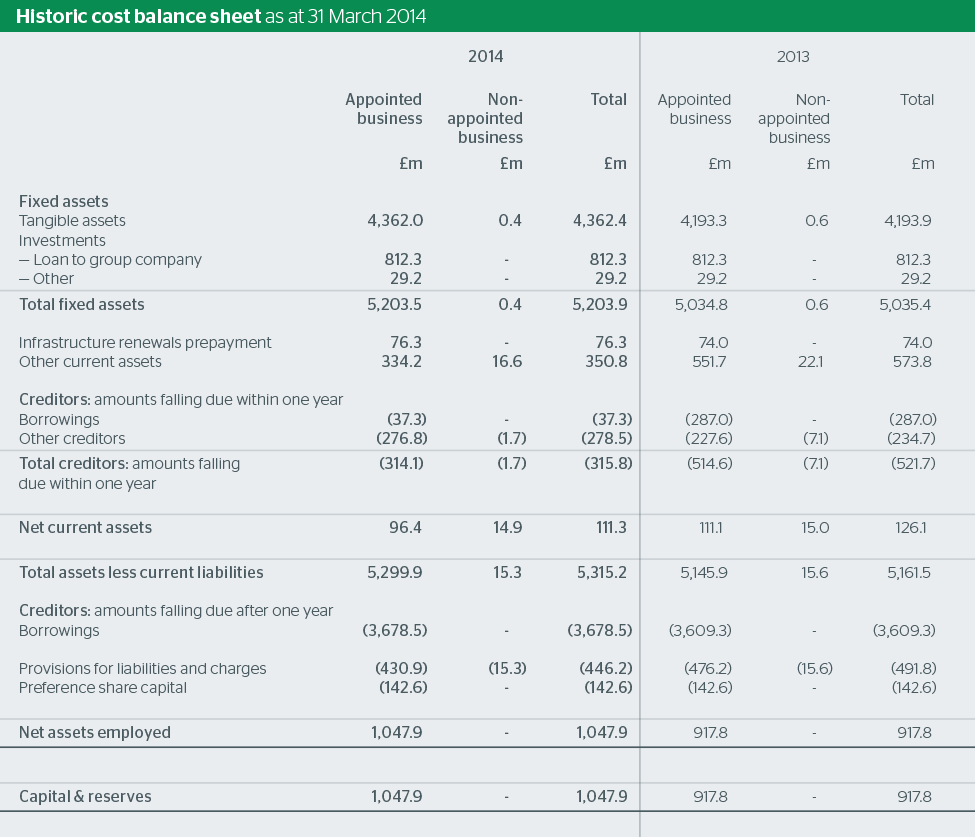

The Balance Sheet

Your balance sheet is a list of assets and liabilities and it’s a key indicator of what your business could be worth.

Image Source: Southern Water

Your balance sheet should include these basics:

- What your business owns: assets could include vehicles, machinery, office equipment or real estate.

- What your business owes: debts due to be paid within 1 year, typically supplier invoices

- Long term liabilities: debts to be paid over several years e.g. bank loans

We think the balance sheet is most useful for larger businesses who are looking to sell or raise money. Balance Sheet Equity, which is total assets minus total liabilities, is an important indicator of business health that investors will look at when valuing your business.

Conclusion

If you aren’t running any financial reports we strongly recommend you start with a monthly cash flow projection at the very least. If you’re a larger business you should have you P&L Statement and Balance Sheet too.

The bottom line is: lack of financial data in a business is a red flag. It’s like playing the game of business without ever knowing the score.