Cash Flow Mastery: Tips for Budget & Expenditure Control

Cash is a key marker of financial health for any business. It’s the factor that enables growth during good times and ensures survival when things get rough. That’s why effective cash flow management is a must-have for all business owners.

We spoke to Dan Crompton, a business coach here at the Business Growth Agency, to discover what you need to know to achieve cash flow mastery and ensure you always have the cash necessary for long-term business success.

Understanding Cash Flow

Cash flow represents the movement of money in and out of your business during a given period. It is not the same as profit, which is the money left over once you’ve subtracted your expenses.

Dan says it helps to think of cash flow data as a snapshot of your finances: “It represents your bank account statement at any point in time, whether that’s historical or forecasting for the future. It represents any cash that hits your account on the day that it hits your account and any cash that leaves your account on the day that it leaves your account.”

Carefully monitoring your cash flow means you can ensure that you always have enough cash to cover your expenses and to take steps to grow your business.

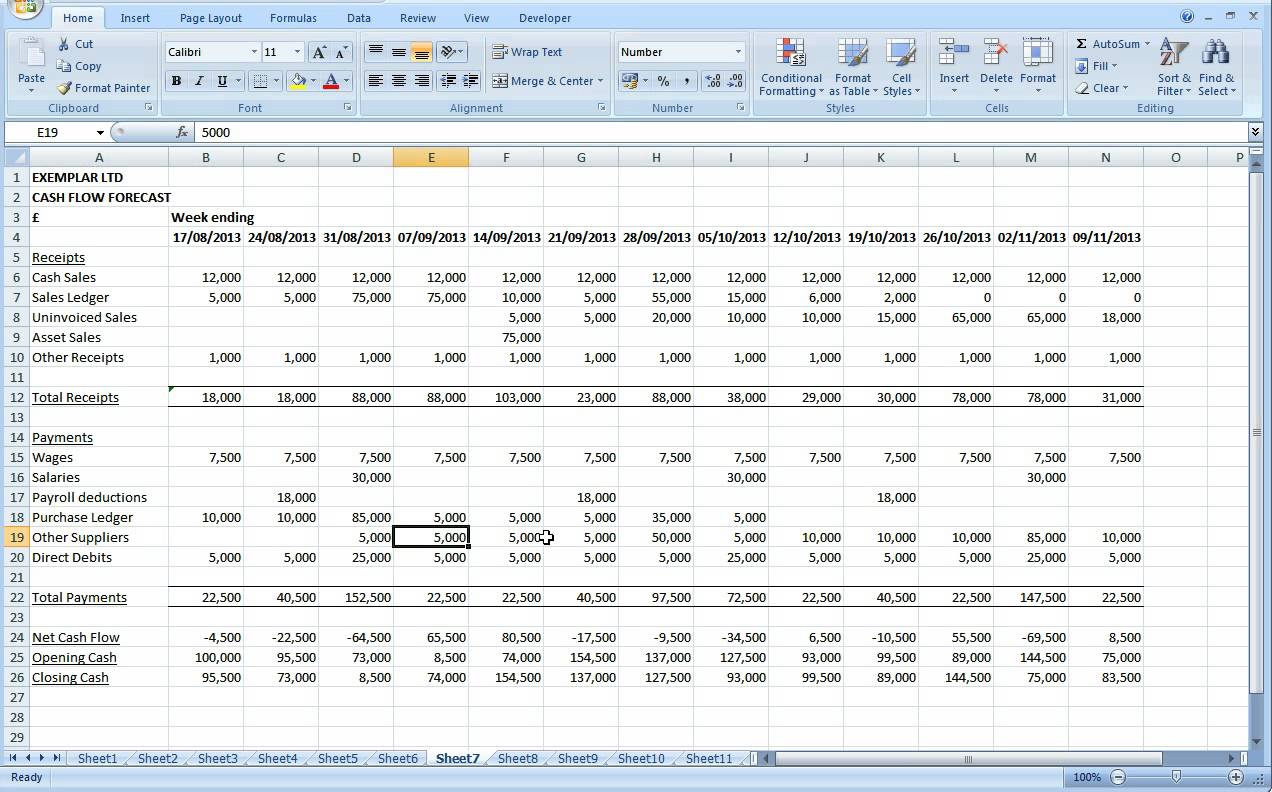

Dan believes that creating a cash flow forecast, a detailed estimate of the money that will enter and leave your account during a specific period in the future, is also vital because it means you can plan ahead.

“The only point in having it,” he says, “is to help you make decisions for your business. So that you can say, for example, I know I can hire someone new in May and here’s how much I can afford to pay them.”

He provides these 3 tips for creating a realistic forecast:

- Find a reliable template, like this one

- Refer to your historical cash flow data. That will give you a more granular understanding of your operating costs and receivables

- Don’t forget seasonal increases and costs. Remember to account for one-off expenses and busy periods

In addition to the practical benefits, this gives you greater clarity and a sense of control over your finances, something that can have a massive impact on your mindset and stress levels as a business owner.

“I think money is such an emotional thing, especially when it’s tight. It affects so much of your life, your mood and your mental health,” Dan explains. “A cash flow forecast is a way of getting all the possibilities – what might go right, what might go wrong – down on paper.”

The Covid-19 pandemic was the perfect proof for the value of cash flow forecasting. He explains that when his clients were facing unprecedented questions about the survival of their businesses, cash flow forecasting meant they could be proactive and start regaining control over the situation.

Using Your Cash Flow Data to Create a Budget That Aligns with Your Goals.

Cash Flow forecasting is a powerful tool for ensuring that each financial decision you make is strategic and consistent with your long-term plan. This means that every outlay you make takes you closer to achieving what you hoped for when you originally started your business.

“Dream big and create ambitious goals,” Dan advises, “then the cash flow forecast is the thing that helps you create a plan of action towards those goals.”

Once you have your goals and your forecast, you can use the data to play around with different scenarios.

“Plan out different scenarios,” Dan recommends. “What if I got that big client, what would I be able to afford in my business? What if I invested in marketing? What impact might that have on both my income and outgoings? What if things go a bit downhill? What decisions would I need to make then?”

Identifying Unnecessary Expenses.

Cash flow mastery isn’t just about understanding your cash flow and using it to plan ahead, you should also be taking steps to optimise it so that you always have the cash you need.

A crucial part of this is introducing cost-saving strategies and reducing expenses. Thankfully, going back through your historical cash flow statements should make spotting unnecessary costs much easier.

Dan’s the first to admit that performing a thorough financial review isn’t the most exciting task in the world but he’s seen it pay off for every single person he’s coached through the process.

“It’s only by doing that slightly boring, slightly painful work upfront that you really get under the skin of what’s going on in your business,” he says. “Honestly, 100% of people who do that exercise spot something that they’re spending too much money on.”

Managing Receivables and Payables for Better Cash Flow

Another important part of optimising your cash flow is actively managing receivables and payables to reduce your cash gap: the amount of time between paying money out and receiving it from your clients. Dan’s top tip for managing receivables is to rethink your payment terms.

“The healthiest businesses and the happiest business owners get paid for the work they do before they do the work,” he explains. “Companies or businesses that either are late in sending out their invoices or whose payment terms allow their clients to pay well after they finish their work – those businesses, in the absence of significant external funding, simply cannot grow.”

If getting your customers to pay the entire amount upfront is unrealistic, Dan suggests asking for at least partial payment upfront. 50% is normal in many industries.

Alternatively, you could spread the cost and the perceived risk for the customer by dividing the work into phases. You can then invoice for each stage of the project before commencing work on it.

His advice for upgrading your payables strategy is the opposite: to delay paying for as long as you realistically can. “The most successful companies on the planet,” he says, “will get as much money in as they can as soon as possible, and they will delay paying out. And there’s no reason why small businesses shouldn’t do the same.”

When to Delegate and Automate

Dan believes that all business owners should delegate the management of their finances by using financial tools like Xero to automate processes and/or enlisting the services of an accountant. However, he is at pains to stress that you, as the business owner, need a real understanding of your cash flow first.

“I think regardless of what systems you use,” he explains, “you should and must have a go at analysing your cash flow manually. Even if it’s just an exercise to understand your business better.”

To do this, he recommends using a basic spreadsheet tool like Excel and manually entering the data.

“Get to grips with the figures, understand what’s going on in your business,” Dan concludes, “then once you’ve done that, look at how to make it simpler, easier, and start delegating things.”

Set a Cash Reserves Goal

Dan says it’s also crucial to build cash in your business and to set cash-building goals so you can monitor your progress. Many small businesses fail to be this strategic about cash, which he feels is a huge oversight.

“As we tell all of our clients, cash is king,” he says. “It is the biggest indicator of the health of a business to ride out tough times, but also to be able to grow.”

Do you have a target cash reserve, a target date when you will get there and a cash flow projection planning out how you will get there?

Conclusion

According to Dan, the key thing to remember is that cash flow is much more than numbers.

“The numbers are just there to tell a story,” he says. “They represent real projects and real clients, real cash in your pocket and what you do with that money.”

-

- As a business owner, you should get hands-on with your cash flow management by reviewing historical data and creating forecasts for the future

- This will enable you to take control of your business’s finances and to create realistic budgets that are aligned with your goals

- It also means you can spot unnecessary expenses and take other steps, such as adjusting your payment terms, to ensure your business has the available cash it needs to thrive

A business coach can help you to achieve cash flow mastery by providing templates and expert advice. If you’d like to learn more, book in for a free 45-minute coaching call with one of our coaches.

You’ll receive practical tips and strategies that you can start using right away to upgrade your cash flow management.