Warning: Are You Risking Your Business By Ignoring Your Cash Gap?

In 2008 Britain’s 3rd largest package holiday operator XL Holidays left tens of thousands of holiday makers stranded after they couldn’t afford to fuel their airplanes. In 2009 Allied Carpets the UK’s 2nd largest carpet retailer went into administration citing ‘cash flow problems’ as the main reason.

If famous businesses like these are capable of such disastrous cash flow miscalculations shouldn’t we be worried that we could unexpectedly run out of cash?

Louis de Rohan, Managing Director of PR agency LDR London, has worked with The Business Growth Agency since 2011 and knows exactly how it feels when unexpected disaster strikes.

“When two of our clients unexpectedly went bankrupt we were left with £52k of bad debt and a serious cash flow crisis”

Louis business was still profitable and growing strongly but the risk was that they might not have the cash available to pay their suppliers and employees. The important thing we both learnt was that growth, profit and revenue mean nothing in that kind of situation – if you run out of cash it’s check mate.

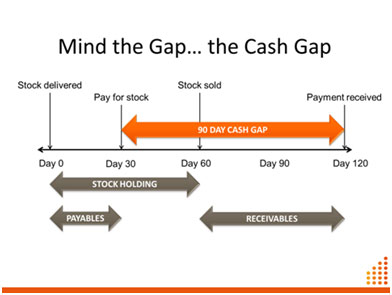

The Cash Gap is the term we use to describe the delay between the time that a business pays it’s costs and the time when it receives payment from it’s customers (see the graphic above). It’s the one metric that’s most important in a cash flow crisis.

Luckily we managed to implement cash flow control and forecasting systems that safely got LDR London through their cash flow crisis. Today they’re on target to grow revenue to £1Million by 2016.

What can you do to protect yourself against these kind of risks? The simplest piece of advice is this – be sure you’re measuring your cash gap and work on reducing it now before you’re in an emergency situation.

The key message here is that no matter how much revenue is rising, if your cash flow and the cash gap is not managed, you could go the way of XL, Allied carpets and so many other supposedly successful household names.

You have been warned.